Seven misconceptions about smart factories

Moderna, the American biotechnology company and maker of the well-known Moderna vaccine, is the poster child of how a digital-first vision applied to a smart factory can be a business game-changer in 2021 and beyond.

In 2018, the company invested in a new 18,600 m2 manufacturing site in Norwood, Massachusetts, and equipped the factory with various state-of-the-art digital technologies that enabled end-to-end testing, developing and scalable manufacturing capabilities for mRNA drug candidates. Some of the latest robotics, automation, AI, data analytics and blockchain technology were deployed to create a digitally connected ecosystem or a ‘smart factory’. The goal was to be able to use the digitally advanced factory to scale up production quickly and with agility, according to the market need.

In 2020, Moderna’s smart factory was put to the test by the COVID-19 pandemic. In July of that year, the company became one of the first US companies to enter phase III of a clinical trial for a potential coronavirus vaccine, just months after the genetic code of the virus was released.

The smart factory became a cornerstone for Moderna to accelerate the vaccine development process in several ways, including using AI-based algorithms for massive sequence optimisation and using digital twin technology to rapidly simulate and test the related production processes. This vaccine development process, which usually takes an average of 10 years, was reduced to months, in part thanks to Moderna’s previous investments in smart factory technologies.

Research by IoT Analytics GmbH on smart factories shows that Moderna’s facility is a prime example of a new generation of factories that are more agile, sustainable, collaborative and efficient than many of the factories that exist today. The company says the report discovered 80 such factories, portrays 10 of them in detail and highlights commonalities and best practices. It also uncovered some common misconceptions about what it takes to realise a smart factory.

What a smart factory really is

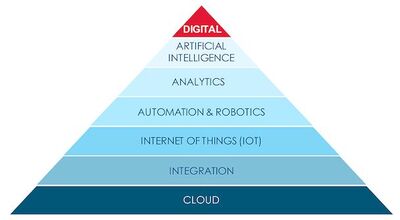

Based on the research, a smart factory is “the holistic transformation of people, processes and technologies along with the use of data to achieve the intended performance/business goals of one or more production site(s)”.

It is important to understand that a smart factory is not a destination or an end goal, but a journey that all manufacturing organisations can embark on at their own pace. The ‘smartness’ of a factory is measured on a spectrum. Factories of all shapes and sizes can assess their maturity and begin their journeys (eg, by using digital maturity models, such as the Acatech model or Fraunhofer’s I4.0 assessment model, which are discussed in the report). This amorphous nature of smart factories has led to the formation of seven common misconceptions, which are discussed below.

Seven misconceptions about smart factories

1. Smart factories must be greenfield projects

Naturally greenfield smart factory projects are easier to realise because there is no existing infrastructure to upgrade and no existing processes that could be disrupted, making planning and implementation much easier. The research, however, shows that many existing (brownfield) facilities are also becoming smarter, in some cases with worldwide recognition.

Industrial automation vendors are at the forefront of showcasing how a brownfield smart factory transformation can be achieved. Two examples are Schneider Electric and Siemens:

- Schneider Electric has showcased how its own technologies (EcoStruxure platform, AVEVA platform) are in use at their own factories. The Schneider Electric facility in Lexington, USA, was recognised as an advanced lighthouse factory by the World Economic Forum in 2020.

- Siemens’ Electronics Works plant in Amberg, Germany, was also recognised as an advanced lighthouse factory by the World Economic Forum in 2021. Using the company’s own solutions, from Siemens Cloud infrastructure to digital twins, the plant has achieved a 50% increase in efficiency and now serves as a guideline for other smart factories.

2. Only large organisations can realise smart factories

It is true that market research from 2019 shows that big companies are further along and less budget-constrained, but there are ways that make realising smart factories viable for smaller companies as well. Here are some examples:

- Financial support: There are several industry associations, like CESMII in the US or the Gaia-X community in Europe, that provide subsidies and support for SMEs who are looking to make their factories smart.

- Determine viability: Non-profit smart factory initiatives, like Smart Factory OWL and Smart Factory KL, allow manufacturers to witness and test certain technologies off-site and discuss them with like-minded professionals before spending on them.

- Pay-per-use: A notion exists that smart factory initiatives involve a lot of CAPEX, infrastructure and data upgrading, and hence are not suitable for SMEs. The rise of as-a-service business models (mostly for software but also increasingly for everything else, including expensive equipment) pushes those costs to OPEX, bringing smart factories within the reach of SMEs.

3. There is a one-size-fits-all blueprint for realising a smart factory

Unfortunately, no two smart factories look exactly alike because each has different production characteristics and, perhaps even more importantly, each has its own performance and business goals.

In the research report, IoT Analytics identified eight typical performance and business goals that were grouped into three types: operational, commercial and R&D. The examples below highlight how different goals can lead to different types of smart factory deployments (in this case the Moderna plant has a different goal than the TRUMPF factory).

- Moderna (operational goal to improve agility): The Moderna example discussed earlier is an example of how increased agility created by a smart factory created tremendous value. In this case, time-to-market was crucial, not just for the company, but for the entire world, and investments in the smart factory ended up eventually paying huge dividends for Moderna, whose stock ended 2019 at <$20/share and today is trading at around $400/share.

- TRUMPF (commercial goal to showcase new offerings): TRUMPF’s Smart Factory in Chicago realises TRUMPF’s vision of networked production and acts as a showcase for TRUMPF customers. One of the main goals of the factory is to showcase the art of the possible and help customers of TRUMPF realise their own smart factories.

4. Smart factory initiatives are mostly about technology

While new technology is often a key part of a smart factory transition, it is not the only part and, according to the research, is not the most important one. Almost all smart factory practitioners interviewed by IoT Analytics in the last two years have pointed towards the importance of less tangible aspects, mostly related to people and processes within an organisation. In fact, when asked about the success factors of Industry 4.0 initiatives, only one of the top 10 success factors revolved around technology.

One particularly important concept to consider is change management, which is required to ensure that the transformation process is transparent and that employees feel included throughout the process. For example, Infineon, a German electronic and semiconductor manufacturing company, introduced change ambassadors at its factory in Singapore. In 2017, it announced a five-year transformation roadmap, and to engage employees right from the start, members of the workers union were appointed as change ambassadors to facilitate two-way communication of new initiatives and promote feedback between shopfloor staff and management.

5. Smart factory initiatives replace existing continuous process improvement projects

Smart factory initiatives need to work alongside existing process improvement tools (eg, Lean Manufacturing, Six Sigma) rather than replace them. Smart factory technologies play a vital part in automating aspects of data collection and analysis, and in eliminating inefficiencies and errors associated with manual processes, thereby improving the efficiency of the continuous improvement process.

Even though the ‘Lean’ methodology in its purest form avoids significant technological assistance, many practitioners now try to use various smart factory technologies to help eliminate different wastes. Figure 2 shows some selected smart factory technologies and which of these can help with which forms of waste.

6. Scaling the successes at one factory to other factories in the network is easy

Scaling from one smart factory to several others is often the most difficult part because each factory set-up is inevitably different from the predecessors, with both the tangible (machine conditions, IT landscape, product features) and intangible conditions (employee mindset, management mindset) being entirely different in different locations.

The journey of a smart factory often begins with a single digital use case and quickly grows into a mesh of technologies and use cases. Approaches on how to navigate the strategic decisions around scaling a smart factory approach vary.

Some companies find that it is easier to first try out some of the technologies and use cases in an existing factory before building a new smart factory from scratch. One example is Siemens, which invested heavily into digitising its existing Amberg plant before deploying a similar set-up, with very minor local modifications, at its greenfield Chengdu plant in China. Siemens claims that, on a technology and process level, the plant is a one-on-one replication of the Amberg plant.

Other companies have employed the opposite approach. Rather than building a new smart factory based on best practices from an existing plant, they build a new flagship plant and use it as the central element in their smart manufacturing network strategy. An example is Bonfiglioli, an Italian manufacturer of power transmission components, which introduced its ‘EVO’ (short for evolution) strategy to build technologically advanced smart factories. The company built a new flagship factory at its Clemintino Bonfiglioli site, Italy, and is now using the plant to recruit new employees, train existing employees and continuously transfer technologies and methodologies to its other plants in various locations worldwide.

7. A smart factory must be fully automated

While many smart factories contain highly automated systems, automation is not a prerequisite for realising the goals of smart factories.

According to the IoT Analytics research, data — not automation — is the key foundation underpinning all smart factory use cases. Technology that enables the acquisition, orchestration and analysis of relevant data will empower the humans running the factory to make faster, more informed and ultimately better decisions. An example is the apparel manufacturer, Hugo Boss. Apparel manufacturing is considered one of the most labour-intensive industries. Hugo Boss’s apparel manufacturing smart factory in Izmir, Turkey, has implemented technologies such as augmented reality, machine learning, cloud computing and data analytics alongside its 3500 workers to produce suits, jackets, shirts and coats. The factory improves efficiency by using more than 1600 Wi-Fi-enabled tablets to capture data and empower frontline employees with order and operational data.

Conclusion

As the example of the Moderna smart factory has shown, investing in production technology, personnel and processes can pay enormous dividends. Today’s generation of smart factories is not necessarily characterised by heavily high-tech greenfield installations. Due to the rapid change in customer preferences and the availability of promising technologies, companies of all shapes and sizes can (and should) have a comprehensive smart factory strategy — regardless of their current digital maturity. The messaging is clear: companies that have already embarked on their smart factory journey will continue to adapt better to the dynamic business environment and grow faster than those that have not.

Here are three action points that, based on our research, have worked for several manufacturers to start their smart factory journey:

- Action point 1 — Focus on a use case and not a technology: Out of the many use cases out there, pick an applicable high-ROI, high-benefit use case and then experiment with suitable technologies.

- Action point 2 — Do not wait for employee engagement: Engage frontline workers from the beginning of the smart factory project and alleviate their doubts through transparent communication, empowering them through upskilling efforts.

- Action point 3 — Tie the smart factory to an existing process improvement initiative: Support the initiative with smart factory technologies to make processes more efficient.

Encoders in motion control applications: Noise and signal distortion considerations

To ensure clarity of signal from your encoder, and avoid excessive electrical noise, there are...

Smart, energy-efficient robot grippers cut production costs

Researchers have developed a new type of robot gripper technology that needs 90% less electricity...

Cobots reduce employee lifting by 50%

As one of the world's largest meat producers, Danish Crown faces challenges in handling and...