Uranium turnaround has companies targeting Aussie deposits

Interest in uranium exploration and mining in the north-east of South Australia is rising to levels not seen in years, as the global appetite for the nuclear fuel source builds.

A number of uranium stocks rallied this week amid speculation US President Joe Biden had included nuclear energy in his clean energy program, delays to planned closures of nuclear power plants in the United States driving up demand and concerns of a supply squeeze when nuclear utilities replace existing supply contracts.

Perth-based Boss Energy says it is in discussions with global lenders to secure funds to become Australia’s next uranium producer with the resumption of operations at the Honeymoon mine in South Australia. The publicly listed company told the Australian Securities Exchange this week the Honeymoon project required just US$63.2 million in capital expenditure to resume, one of the lowest funding requirements of any pre-production uranium project worldwide.

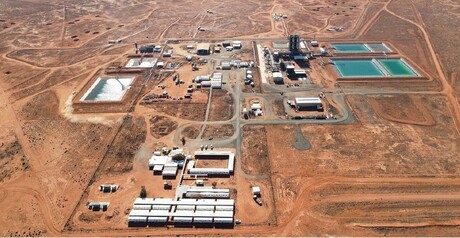

Honeymoon is about 80 km northwest of Broken Hill and is one of only four permitted uranium mines in Australia. It was mothballed in 2013 because it had become too costly to run. However, its new owner Boss Energy announced in January last year it had developed technology to lower operating costs and was looking to commence production at Honeymoon within a year.

Boss says it has already signed confidentiality agreements with several global lenders and formal indicative financing proposals are now being sought with a view to ensuring debt funding is well advanced when the company seeks to finalise offtake agreements.

It says it is also on track to complete the Enhanced Feasibility Study (EFS) on Honeymoon in the coming quarter. Boss Managing Director Duncan Craib said completion of the EFS, project financing and offtake was expected to coincide with a rising uranium price.

“There is a widespread expectation that uranium prices will rise in the near term as the supply deficit grows,” he told the ASX last Monday. “Our strategic timetable is aimed at ensuring we are in a position to sign long-term offtake agreements when prices strengthen, locking in robust margins and substantial free cash flow in the process.

“This strategy is underpinned by the fact that the 100%-owned Honeymoon is already fully permitted, including the permit to export uranium. It also has an existing plant (in care and maintenance) and a large JORC Resource, and will have one of the lowest operating costs among uranium producers worldwide.”

World uranium prices have been sluggish for several years but enjoyed a surge last year. The world price on Tuesday was US$29.85 US per pound, up 27% on its price of $23.50 a year ago.

Meanwhile, a new company registered to an Unley Park, SA, address has entered into an agreement with Havilah Resources to secure the exclusive uranium exploration and mining rights for uranium deposits in the north-east of South Australia. The deal is subject to Aroha Resources listing on the Australia Securities Exchange in the next 12 months. Aroha registered as a company in September and includes resource industry leaders Reg Nelson and Neville Alley on its board.

The Havilah exploration licences are between Broken Hill and Lake Frome in the remote north-east of South Australia. Many of the licences are believed to be highly prospective for uranium deposits, similar to the nearby Honeymoon uranium project.

Havilah’s primary targets are copper, gold, cobalt and iron ore. Its uranium interests were acquired via the takeover of Curnamona Energy Limited in 2012. Havilah’s Technical Director Dr Chris Giles said the company was delighted that Aroha intended to fund and advance Havilah’s extensive uranium interests.

“Aroha’s team is well experienced and highly successful in the Australian resources industry and we look forward to working with them,” he said in a statement to the ASX.

Fellow South Australian mining company Marmota announced in June that rising global uranium prices had prompted it to launch a strategic review of its Junction Dam uranium project about 15 km from the Honeymoon mine site. Marmota owns 100% of the uranium rights at Junction Dam but has not been active on uranium since 2014, at which point it had spent AU$8 million on uranium exploration.

According to the World Nuclear Association, Australia has about 28% of global uranium resources but only produces about 12% of mined uranium, third behind Kazakhstan (42%) and Canada (13%). About half of Australia’s uranium comes out of BHP’s Olympic Dam mine near Roxby Downs in the north of South Australia, which is the world’s largest known uranium deposit.

The other two operating uranium mines in Australia are the Ranger mine east of Darwin in the Northern Territory and the Beverley-Four Mile project, in the north-east of South Australia.

The 2019 edition of the association’s Nuclear Fuel Report forecasts a 26% increase in uranium demand between 2020 and 2030.

Vaxxas secures TGA licence to manufacture vaccine patch technology

Milestone enables GMP manufacturing to accelerate clinical trials and transform global vaccine...

DroneShield nabs another European military contract

DroneShield has recently announced it has received a new contract for AU$49.6 million for...

Daikin Australia opens new Sydney factory

Daikin Australia has opened a new factory in Chipping Norton that aims to accelerate the...