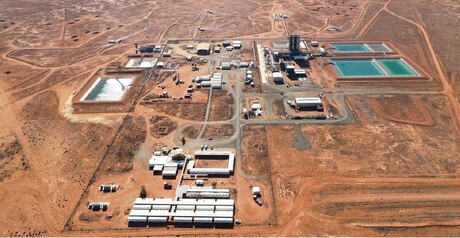

Honeymoon mine to recommence uranium production

In an ASX announcement on 31 March, Boss Energy Limited announced that the recently completed FEED study on its Honeymoon Uranium Mine in South Australia highlights a technically and financially robust project.

Importantly, the FEED study confirms that the cost estimates in the Enhanced Feasibility Study (see ASX release dated 21 June 2021) remain accurate.

The EFS found that Honeymoon is economically robust with an IRR of 47% at a US$60/lb U3O8 price, and technically robust with nameplate production of 2.45 Mlb U3O8 per annum with a potential to extend beyond the initial 11-year mine life through near mine satellite deposits.

Boss Managing Director Duncan Craib said the FEED provided more strong evidence of the outstanding outlook for Honeymoon.

“The planets are aligning perfectly for Boss and Honeymoon in every respect,” Craib said. “The FEED shows Honeymoon’s costs are in line with the forecasts contained in last year’s enhanced feasibility study, which is a superb outcome given the wider inflationary environment.

“It also confirms that production is projected to meet our targeted levels. These key findings come against a backdrop of significant increases in the uranium price and an exceptionally strong supply-demand outlook.

“Our recently announced $125 million equity raising, combined with the value of our strategic uranium inventory, means we are fully funded through to production and cashflow. All these highly favourable factors have laid exceptional foundations for us to make a final investment decision in coming weeks, ensuring Boss will be Australia’s next uranium producer.”

In September 2021, Boss committed to a FEED study with a target end date of 31 March 2022.

All targeted outcomes were achieved by the FEED, which focused on progressing the design of the processing plant and infrastructure as well as optimising the mining and wellfields to enable a detailed capital cost estimate to be prepared to a level of accuracy of ±10%.

Based on the FEED study, the total capital estimate for the development of Honeymoon is AU$113 million.

The FEED study assumes that the process plant is developed under an Engineering, Procurement, Construction and Management contract. Based on Boss’s current plans, first uranium is expected to be produced at Honeymoon within 12–18 months of Final Investment Decision.

Completion of FEED enables Boss to proceed with detailed design to commence immediately after a FID for Honeymoon’s restart is made. FID is expected after completion of the Tranche 2 Placement on or around 5 May 2022, whereupon the company will immediately commence with detailed engineering, procurement and construction works.

New liquid catalyst to transform chemical manufacturing

A major Australian breakthrough in liquid catalysis could transform how essential products are made.

Aussie manufacturing conditions improve at fastest pace since 2022

S&P Global has reported that Australia's manufacturing sector experienced its strongest...

The engineering workforce is critical to securing Australia's future

Engineers Australia says the next federal government needs to prioritise real action on...